"*" indicates required fields

Get Started Today!

Save with No Fee Checking

Just keep $1,500 in your account and you will be automatically reimbursed for ATM fees other banks may charge up to $45 a statement cycle.

Open An Account

Seamless Transfer of Funds

We offer a variety of tools to send and receive funds to and from your Hingham Savings checking account. These tools include online transfer, bill pay, ACH, wire transfer, mobile deposit, Google Pay and Apple Pay.

Open an AccountWe Are Here to Help!

Our team is always here to help with any questions you may have about your account. Just click on the message box in the lower right hand-corner of this webpage to chat with a team member.

Visit our Help Center-

Karli Kouris

Digital Payments Specialist -

Gregory Mondello

Digital Payments Specialist -

Amanda Cappiello

Digital Banking Specialist -

Glenn Loury

Digital Banking Specialist -

John Lauterhahn

VP - Customer Experience Manager -

James Leeson

Customer Experience Specialist -

Catherine Liu

Customer Experience Specialist -

Tanya Gordon

Customer Experience Specialist -

Fionna Feerick

Customer Experience Specialist

Karli Kouris

Digital Payments Specialist

Karli is a Digital Payments Specialist and a member of the Bank’s Digital Banking Group. She is responsible for managing, enhancing and developing our digital payments systems that support our deposit operations. Prior to joining Hingham, Karli was employed at South State Bank. She brings over 18 years of banking experience to her role including customer service, retail operations and digital banking.

[email protected] 781-783-1767Gregory Mondello

Digital Payments Specialist

Gregory is a Digital Payments Specialist and a member of the Bank’s Digital Banking Group. He is responsible for managing, enhancing and developing our digital payments systems that support our deposit operations.

Prior to joining Hingham, Gregory was employed at First Republic Bank. He has a degree in International Business from Merrimack College and nearly two decades of experience in the banking industry.

[email protected] 781-783-1809Amanda Cappiello

Digital Banking Specialist

Amanda is a Digital Banking Specialist in our Digital Banking Group. She is responsible for managing, enhancing and developing our digital banking systems that support our deposit operations. She brings over 10 years of banking experience to her role including both retail and back office roles.

[email protected] 781-783-1747Glenn Loury

Digital Banking Specialist

Glenn is a Digital Banking Specialist and a member of the Bank’s Digital Banking Group. He is responsible for managing, enhancing and developing our digital banking systems that support our deposit operations. Glenn has over 10 years of banking experience working in operations roles.

[email protected] 781-783-1751John Lauterhahn

VP - Customer Experience Manager

John, our VP of Customer Experience, leads our team in delivering exceptional service across digital and phone channels. His 20 years of experience in the banking industry and education from Massachusetts College of Liberal Arts and Villanova University make him a valuable asset.

[email protected] 781-783-1764James Leeson

Customer Experience Specialist

James is responsible for managing and enhancing the experience of our customers through digital and phone channels. He has over 10 years of experience in customer service and banking.

[email protected] 781-749-2200Catherine Liu

Customer Experience Specialist

Catherine is responsible for managing and enhancing the experience of our customers through digital and phone channels. She has over 20 years of experience across banking, financial services, and customer journey management. Catherine lives in New York and loves spending time with family and shopping for antiques.

[email protected] 781-749-2200Tanya Gordon

Customer Experience Specialist

Tanya is a graduate of Eastern Connecticut State University with a degree in Business. She possesses 14 years of experience within the banking industry. In her leisure time, Tanya enjoys relaxing at home with a good film and appreciates spending time in nature, particularly at the beach.

[email protected] 781-749-2200Fionna Feerick

Customer Experience Specialist

Fionna is responsible for driving improvements to the customer experience across digital and phone platforms. She leverages a strong quantitative background, holding both a B.S. in Pure and Applied Mathematics and an M.S. in Data Science with a Concentration in Business Applications from Stevens Institute of Technology. Outside of her professional work, Fionna is a dedicated distance runner, a dog lover, and spends her free time outdoors whenever possible.

[email protected] 781-749-2200

Debit Card

Keep a balance of $1,500 in your checking account and you won't get charged for any ATM fees (up to $45 a statement cycle). We also offer contactless payments using the Tap and Go feature on your debit card, Apple Pay and Google Pay. Already have a Hingham Savings checking account? You can order a debit card today!

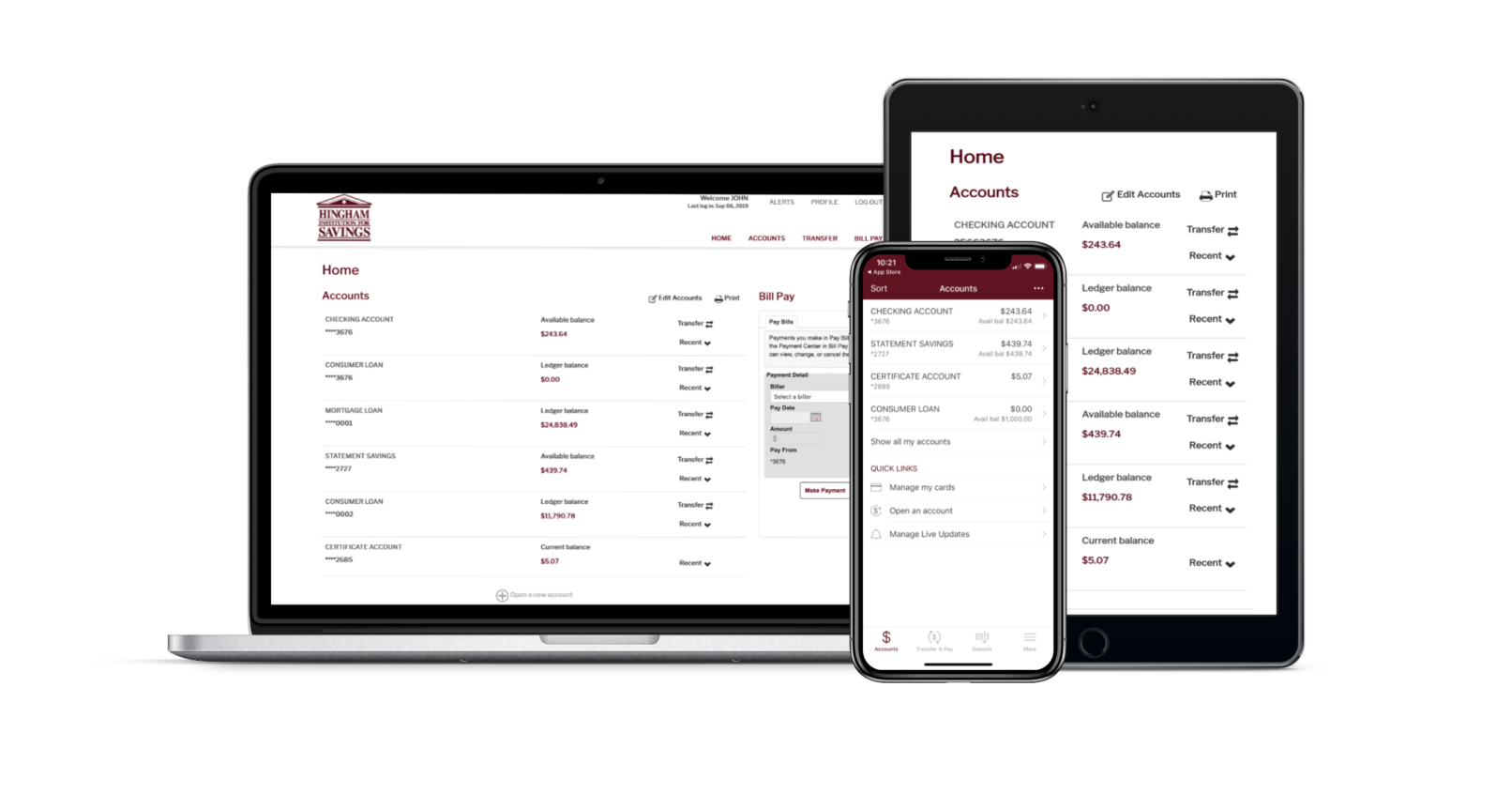

Order a Debit CardExplore Our Digital Tools

Deposit checks, transfer funds and pay your bills using our mobile or online app.

Learn More

Please note that this link will take you away from Hingham Institution for Savings and does not represent sponsorship, endorsement, or guarantee of information on an external site.

Hingham Institution for Savings is not responsible or liable for the content, information, security or failure of any products or services advertised on promoted on any external site or any external site's privacy or data protection safeguards.

Continue Cancel